By Desmond von Teichman Broker of Record, Owner, Royal Le Page Locations North Realty, Brokerage

Change is constant and is a theme for me in these market watch pieces. Whether it is a change in the market itself or a change in policy, service or technology that we use to disseminate information to our clients and the consuming public at large, real estate is continually evolving. Data, and where and how we see it is something that the real estate industry is talking about a lot right now.

Anyone who has looked to buy a house in the last 20 years has likely found themselves “shopping” on REALTOR.CA®. This portal has been the go-to place for current real estate information for ages. But does anyone remember what was used before that?

There was a time when, if you wanted to know what was for sale in a given area, you had to physically walk in to a real estate office and speak to a REALTOR®. They could tell you what they had for sale, or what they might know their colleagues had for sale by chatting with them. There was no systemic organization that monitored and published any kind of real estate data.

Fast forward a few decades and something wonderous happened. The Multiple Listing Service or MLS® came to be. Now you could walk physically into a real estate office and they could give you access to an MLS “book”. This “book”, which was actually more like a hybrid between a newspaper and a magazine, was published regularly and contained the new listings, price changes and sold data. At the time, it was the only meaningful source of real estate information available., and it was a game-changer. Many industry folks lamented the change and yearned for the old days where only they could sell their listings and they would not have to cooperate with others to do so.

What do you suppose drove this great leap forward? Certainly, there were many forward-thinking people in the industry that came together to make this happen.

But at the end of the day, I think we can all agree it was the consumer that facilitated this change.

“What do you mean I can’t see the house that the guy across the street has listed? Why not?”

Why not indeed? It seems a small thing these days, but cooperation shook the industry at the time. But the industry adapted. Why? Because the consumer needed them to and they listened.

Fast forward another few decades and we saw the dawn of the early days of the internet and an inexorable shift towards open data. Consumers now had better access to real estate data, but again…only through their real estate professional in the form of a physical book that could only be accessed in the REALTOR®’s office. Was that good enough? The consumer didn’t think so, and forward-thinking industry folks like Royal LePage released the first real estate online portal before even MLS® got their data online.

Again, the industry was fractured. What will happen if the consuming public doesn’t need to see a REALTOR® to get access to listing data? The answer was not a doomsday scenario, but rather a system where a Canadian consumer could go online and see every house for sale in real time. Not just in their neighbourhood, city or province, but all across the country. Open listing data, conveniently presented and totally self serve. And because it was a regulated data source, the integrity of the data was of the highest calibre.

When the industry adapts to the needs of the consumer, everyone wins. And I don’t think we should understate the uniqueness of this situation. A cohesive coast to coast MLS® is something that most Canadians take lightly. Did you know that we are one of the only places that has had such a thing until recently? In the US a true central data aggregation service didn’t really come into existence until recently when a number of third-party aggregators like Zillow came along and shook things up. Zillow quickly became the real estate site with the most eyeballs in the US as they created what Canadians already had. Great access to information.

Now to present day. Data’s importance continues to grow and the debate about its dissemination rages on. In August, the Supreme Court of Canada refused to hear the Toronto Real Estate Board’s case seeking to limit the dissemination of sold and other types of real estate data on what is known as “Virtual Office Websites” or VOW’s. VOW’s are password protected sites where clients can go to access additional real estate data to aid them in their search. Data like the sale price of homes, expired listings, and interpreted data on trends.

One of the chief arguments against allowing access to sold data was that of privacy for the consumer. This is an important consideration to be sure, but sold data does become a matter of public record at some point, and I am not sure that the industry is well-served by trying to limit access to the data that the consumer is looking for.

For me, consumer-centricity must be at the heart of our offering. Whether it is in delivering stunning customer service, the best of local knowledge, or the delivery of data that makes the consumer more informed. Certainly, the latter must be measured against the privacy rights of others, but I do not think that these things need to be mutually excusive.

Just like the original data that was distributed through the MLS® many years ago, new data fields must be checked for accuracy and be well-regulated to make sure that the consumer is getting what they want and need.

So…the new data war will be fought online. The Canadian Real Estate Association will invest heavily in the REALTOR.CA® platform in the coming years to add data, data analytics, tools and widgets to improve the consumer experience. Brands like Royal LePage will invest in products like their vaunted “My Perfect Life”, which uses data interpretation to aid consumers to help them find an ideal neighbourhood. Brokerages will roll out VOWs to give their clients better access to data. And third-party aggregators will do all of the above in order to battle for the eyeballs of the real estate buying public.

Is all of this investment going to help the consumer? You bet it will! Will access to the data make the REALTOR’S® job redundant? I don’t think so. If anything, I think a trusted advisor that can help you navigate through a complex, high-value transaction and help you arrive safely and securely at a point where you know you have made the right decision will be more important than ever.

Real estate market activity across southern Georgian Bay in August showed a slight improvement in dollar volume over the same month last year raising the question after seven prior months of weaker sales than the same time in 2017, will this upward trend continue?

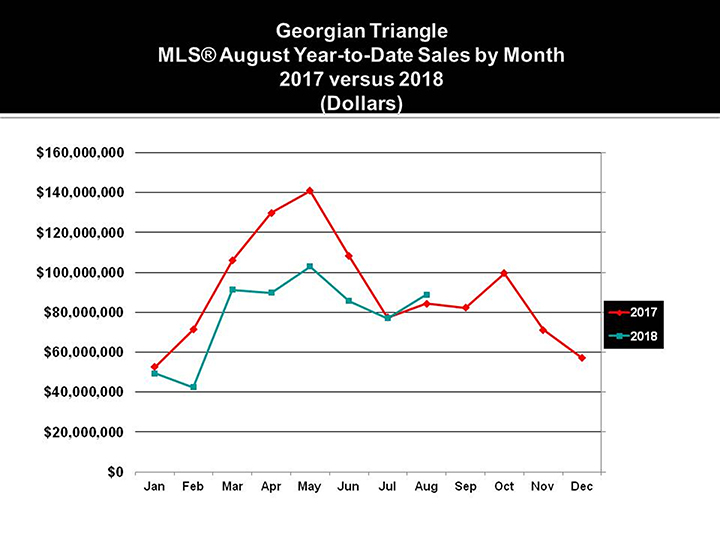

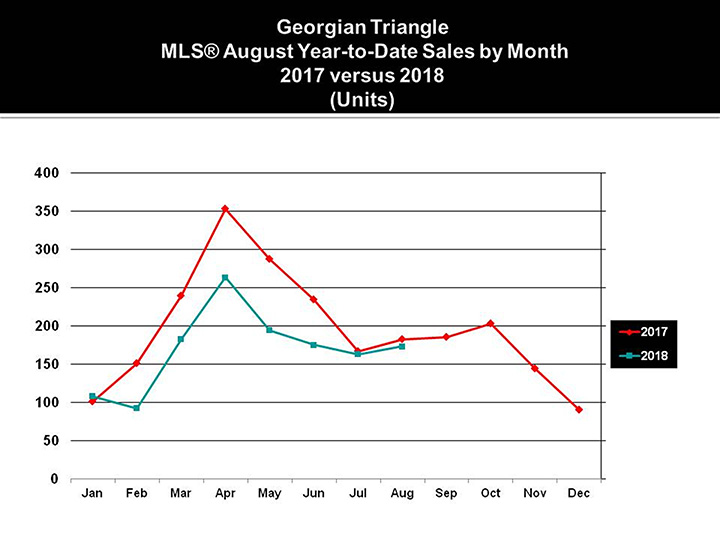

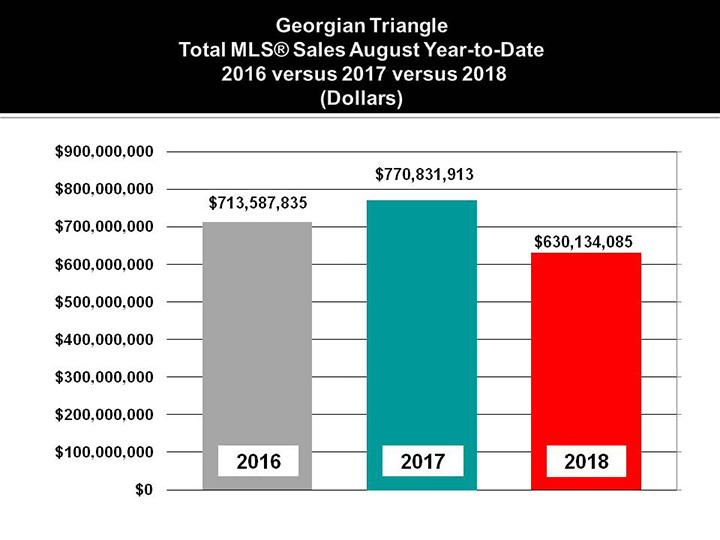

MLS® sales reported by the Southern Georgian Bay Association of REALTORS for the month of August totalled $88.8 million, an increase of $4.5 million or 5% over August 2017. This was the first month in 2018 when MLS dollar sales exceeded the same month of last year. Despite the modest upturn in dollar sales during August, year-to-date MLS® dollar and unit sales both remain at significantly lower levels that the first eight months of 2017. Year-to-date MLS dollar sales of $630.1 million represents an 18% decrease from last year while unit sales of 1,287 properties are 21% lower than the 1,626 MLS® units sold in the first eight months of 2017. Mid way through 2017 overall real estate activity in most markets across Canada began to slow and the Greater Toronto Area (GTA) which is a major feeder market for property demand in southern Georgian Bay is no exception.

Slower sales in the GTA, as well as Guelph, Kitchener/Waterloo and London combined with tighter lending rules have all served to reduce the frenetic sales pace we experienced in our market during 2016 and 2017. This is not necessarily a bad thing as slower sales, the reduction in multiple offers with highly inflated sale prices lends to a more balanced market favouring sellers and buyers equally.

The change to softer MLS® sales across our region from 2017 is consistent in every municipality that make our market. Overall year-to-date MLS unit sales are down from 20% to 34% and are broken down as follows: Collingwood -20%, Municipality of Meaford and Wasaga Beach are both 25% below last year, Clearview -28%, while the Blue Mountains and Grey Highlands are down 32% and 34% respectively. As with sales activity by municipality, decreased sales are reflected in every price segment of our market with a particular emphasis on the upper end market from $1 million and up. Sales between $1 and $1.5 million are 20% below 2017 with 41 sales this year compared to 51 in 2017. Sales in the $1.5 to $2 million range are down 61% from last year with just 7 sales this year versus 18 sales last year.

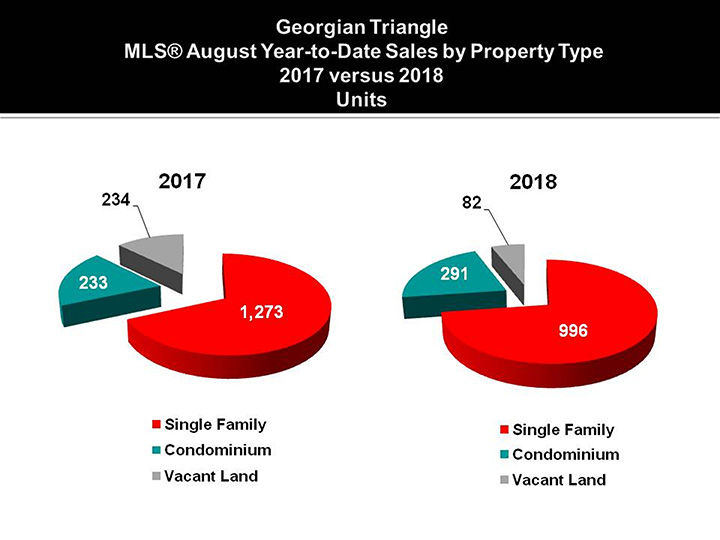

One bright spot in market activity this year is the sale of condominiums. MLS condo sales through the end of August total 291 units compared to 233 this time last year, an increase of 25%. For many buyers condominiums are a less expensive alternative with less upkeep than a single family home. By comparison, MLS® single family home sales are down 22% with 996 sales reported this year versus 1,273 sales during the same period last year. Lastly, vacant land sales are greatly reduced from one year ago largely due to a lack of inventory. Year-to-date vacant land MLS® sales total 82 properties compared to 234 sale in the first eight months of 2017. Please keep in mind the statistics provided herein do not include sales made by builders and or developers that do not go through the local MLS system but are made directly by the builders/developers own sales staff.

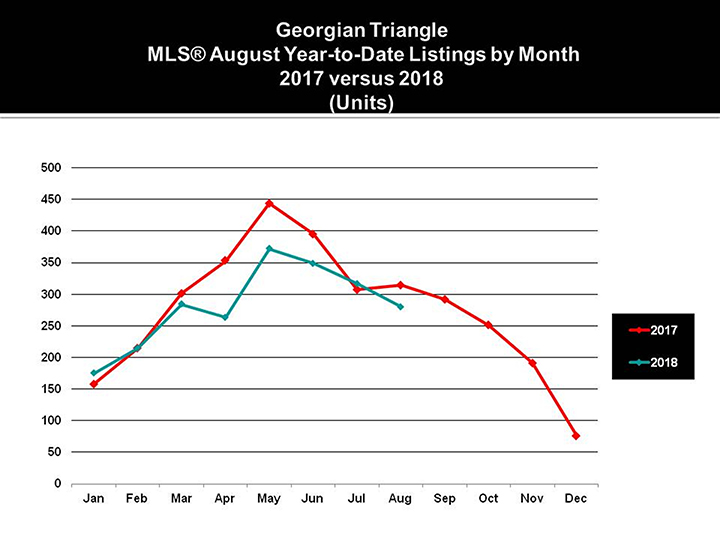

Tighter lending rules combined with an ongoing shortage of inventory listed for sale have both contributed to the current slowdown in MLS sales activity we have experienced in 2018. While properties listed for sale have increased somewhat this year, new listing activity is still 7% below the level of last year. Conversely, expired listing activity has increased significantly this year with the number of expired listings up 46% to the end of August. While sale activity has softened, some sellers are still asking above market value for their properties hoping to attract a willing buyer. As always, consumers need to adapt to changing market conditions and whether you are buying or selling, working with a knowledgeable REALTOR® can work to your advantage in meeting you real estate investment goals.