Irrational Exuberance

Words by Desmond von Teichman

If you are a regular reader of this piece, you will note that I have been saying for some time that the constant upward pressure on prices in our area was neither healthy nor sustainable. The pandemic brought unprecedented demand to our area, and there simply was not sufficient supply to meet it. Scarcity led to price increases and the rest is in the rearview mirror.

Even as I wrote my last Market Watch piece in late March, we had seen an unprecedented first quarter price increase in our area on the order of 40% year to date. Then, as these things do, a change took place. You can blame inflation, you can blame interest rates. But the best characterization I have heard for the change came from Phil Soper who is the CEO of Bridgemarq Real Estate, the company that owns Royal LePage: “The change in this market”, he said at a recent conference, “reflects the end to irrational exuberance in the real estate marketplace.”

“Irrational exuberance.” Think about that for a second. What a great way to characterize a pandemic phenomenon that saw a true migration of the populace. That characterization accurately reflects the concept as well that there may not be a change in the fundamentals of the market. Merely the frenetic pace at which people participated in it.

But a significant change in the balance of the market brings a significant need for change management. Change is constant, and both the real estate industry and the consumer need to adapt. A mentor of mine gave me some words of wisdom at the beginning of the pandemic: “You can only trade in one market, Des. Today’s market. You can’t trade in yesterday’s and you sure as hell can’t trade in tomorrow’s.” So, for the people trying to “time” the market… there you go. You missed it. But that is the case almost every time someone tries to “time” something that is influenced by something as fickle as irrational exuberance.

The good news is that almost everyone who is a seller in our market is also a buyer. Sure, you might get less for your property today than you would have a couple of months ago, but the dollars you realize from that sale will also go further in a down market. There is an elegant balance to the thing. Of course, the best would be to sell at the peak and then wait until it bottoms. But my goodness…. good luck “timing” it.

In our business it comes down to change management. We don’t make the market, but we do our best to provide good and timely advice to help our clients understand it and to be their trusted advisor in the process. This has never been more important than it is now.

Last week, I got a call from one of my newer agents. She was seeking advice as to how to best serve their seller client by getting their home sold. It was one of her first listings and the seller, similarly, was selling their first home. My agent had thrown the kitchen sink at this listing—she seriously knocked it out of the park; creative and professional marketing; real elbow grease in introducing the listing to the neighborhood; you name it. But she called me because her seller was really concerned. They had had only four showings and no offers. So, we went over it, and I asked her how long the property had been on the market. “Five Days,” she exclaimed! “I can’t believe it!” Now, I have been around the block a few times and have experienced all kind of markets—sometimes we take it for granted that everyone understood that the market we have found ourselves in for the past two years was not normal. A newer agent and a first-time seller can be forgiven for having these expectations as they have never known anything else. But the fact of the matter is that we are not in a seller’s market today. Some balance has returned. Some rationality.

Our expectations need to change. Your house won’t sell in a bidding war within 43 minutes of putting it on the market. REALTORS® are going to have to dust off some old tools. Guess what? Open houses are back! The consumer is going to have to interview the people they want to hire to get the job done, because the days of being an order-taker are gone for now. Letting the market set the price isn’t an option. Price is again a cornerstone of a cohesive and well laid out marketing plan. And that’s just fine by me.

I am not an economist, but I follow a number of economists that I respect. Are we headed into recession? I am not betting on it. Yes, we are worried about inflation. Yes, interest rates are on the way up. But did anyone actually think they could remain on the bottom forever? Fundamentals. We have close to statistical full employment. Even conservative politicians in this country aren’t pointing to austerity budgets. However, the unknown and unpredictable behavior of the populace could throw a monkey wrench into things.

As always, I return to fundamentals. We live in a great place. I believe that demand will outstrip supply in the long run so long as supply is limited by systemic governmental forces. I believe the market will give back some of what it gained. But I believe that it will be short-term. And real estate is not a short-term game. Where we live matters and that is a long-term conversation.

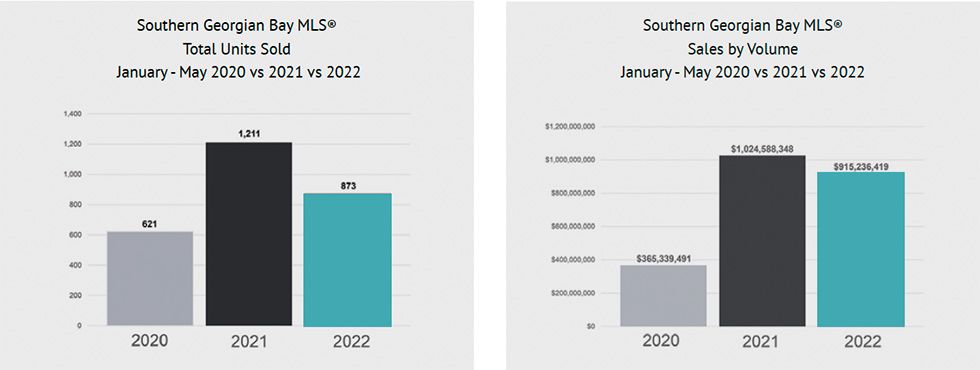

Regarding the Southern Georgian Bay real estate market, the momentous change from a sellers’ market in the first quarter, to a more balanced market we have witnessed since April, is showing signs of being a trend rather than a blip. On the volume side, April had sales of $206,660,128, while May had sales of $161,679,577. Those numbers were down 21% and 32% respectively from last year’s big records of $260,289,200 and $237,157,454. That said, this year’s numbers were still the second-best ever for both months, although they are heavily influenced by record-breaking monthly sales prices.

On the units’ side, April’s 200 sales and May’s 166 were down 35% and 39% respectively from last year’s 309 and 271. To put those numbers in perspective, April’s were the sixth best for the month in the last 10 years, while May’s were the ninth best. Further, April’s sales came on 414 new listings, yielding a 48% sales/listings ratio (down 21% from last April); while May’s sales came on 453 listings, yielding a 37% sales/listings ratio (down 30% from last May).

Notable, despite the slowing sales, was the fact that April still had a relatively high 100.4% sale/list price ratio, with May dropping just slightly to 99.8%. To put that in perspective, from the beginning of the sales boom in June 2020 to March of this year the sale/list price ratio was 100.3%. So, despite the current waning demand, those who do sell are still generally getting very close to their asking price. And we are still seeing multiple offers in specific categories.

As far as average sale prices go, May’s average sale price of $972,932 (for single-family homes, townhouses and condos combined) was up 86%, 65% and 11% from the Mays of 2019, 2020 and 2021 respectively. However, it is necessary to point out that the Southern Georgian Bay region’s average sale price hit its peak in January at $1,139,331 and has been trending down ever since. As such, May’s average price, at $972,932, is down 6%, 3%, 14% and 15% from April, March, February and January respectively. But going back to the beginning of the piece where we noted that the first quarter price increase was 40% higher than the previous year, there is certainly room to give back.