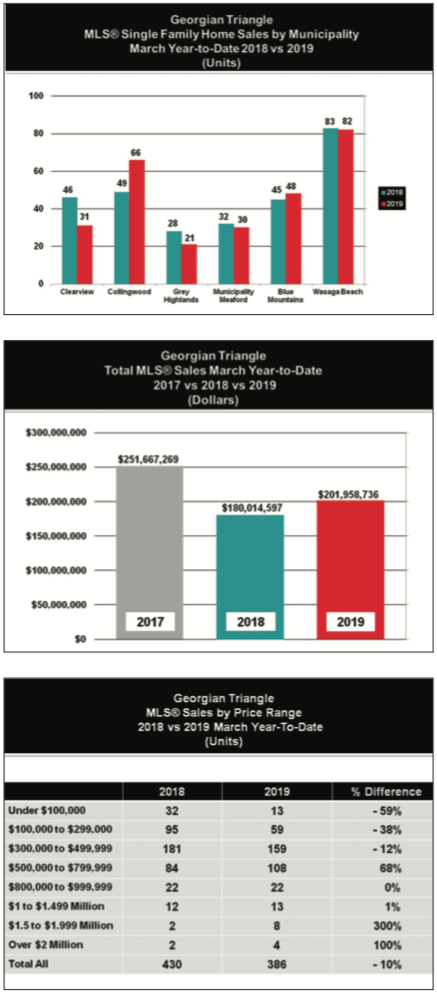

Similarly, sales over $2 million have doubled with 4 MLS® sales reported versus just 2 sold at this time last year. These numbers clearly reflect a strengthening in the luxury market, particularly in the Blue Mountains where almost 50% of sales above $750,000 in our market area take place.

Sales in the lower price segments of our market con- tinue to remain weaker than last year particularly in the $100,000 to $500,000 price ranges. First, it is important to note that properties in the lower end of this category are becoming rarer and rarer. Sales under $100,000 in the 1st quarter of 2018 totalled 32 units whereas this year there we only saw 13. During the first three months of 2018 there were 181 MLS® sales in the $300,000 to $500,000 price category. This year the number has dropped 12.1% to a total of 159 properties sold. Scarcity is likely at play here and we are seeing a fair number of multiple offer situations as a result. One property that was listed just over $200,000 in the northeast part of our trading area attracted a staggering 30 offers!

MLS® condominium sales during the 1st quarter total 68 units, a decrease of 23.5% from the first three months of 2018. Some of this decrease may be attributable to a significant number of new condominium units being built and sold in the area by developers which are not sold through the local MLS® system. We do expect inventory to strengthen in the second quarter as is normal after the winter market.

Overall, we continue to experience a general shortfall of inventory listed for sale on our local MLS® system. Year- to-date, the number of new listings for residential properties totals 674 units which is a modest 3.3% increase above the number of new residential listings that came to market in the 1st quarter of 2018. While demand still exceeds supply, properties listed for sale are lingering on the market a touch longer before selling. For the 1st quarter of 2019, days on market have increased to 56 from 47 last year. The only exception to the inventory shortage is in the upper price ranges of the market where inventory remains stronger. The level of MLS® listed inventory overall however is showing signs of trending upwards, which is encouraging for those looking to buy. This may push the market closer to balance if inventory continues to strengthen.

Bring on Spring!!! |E|