By Desmond von Teichman Broker of Record, Owner, Royal Le Page Locations North Realty, Brokerage

One of the first things that you have to do when buying or selling a property with a REALTOR® is to establish the relationship be- tween you. This is normally accomplished through an agency agree- ment such as a Buyer agency or listing agreement in the case of the sale of a property. Why do we need this? Well…#1, The Real Estate and Business Brokers Act 2002 demands it. Probably more important though is the specific responsibility the client relationship creates.

The way we represent a client is what most people think about when establishing a relationship, but the duties that the relationship imply are at the very core of the value that a REALTOR® provides to a client.

Most people have heard of fiduciary responsibility, but I’ll wager most don’t really grasp what it means to them. The Business Dictionary defines Fiduciary duty as “A legal obligation of one party to act in the best interest of another”. Seems pretty straight forward right? Maybe another example of “The Golden Rule” in action (the do unto others one….not the “he who makes the gold, makes the rules” one).

The sub-obligations of fiduciary duty are where the rubber really hits the road. While there are a number of interpretations here, the one I favour has the acronym OLDCAR. Obedience, Loyalty, Disclosure, Con- fidentiality, Accounting and Reasonable Care.

Obedience: It would seem obvious that we must obey the lawful in- structions of our client. In most cases, this is no issue at all. We advise our client and then act on the client’s direction. The only time we get into sticky situations is with the lawful part. I occasionally have had one of my REALTORS® come to me looking for advice when their client asks them not to mention the leaky basement or the contaminated well to po- tential Buyers. My advice is always the same: Disclose, disclose, dis- close. This isn’t only for their well-being. If there is something that needs to be said, it is almost universally better to control how that information is presented rather than having another party to the agreement discover the omission later. That leads to lawsuits. My father is a lawyer and he tells me that the only one to win in a lawsuit is….well….you know.

Loyalty: The fiduciary must be loyal to their client and keep their best interests ahead of any other party, particularly your own. While this seems like a no-brainer, there is a perception that some unscrupulous practitioners would rather see the commission from both ends of a deal than the best for their client represented. There are bad apples in every bunch to be sure, but in my experience, loyalty is something most people I am exposed to take extremely seriously.

Disclosure: This generally refers to the fact that if you know some- thing about a property that could affect someone’s enjoyment or desire to purchase, it must be disclosed. The above example of the leaky base- ment is pretty common in the business, but you may be surprised what we have disclosed in order for some people to make informed choices. Grow-ops…obviously. Death of an occupant…you bet. Ghosts….Yup… .I ran into that one recently.

Confidentiality: I think this is a big one that isn’t discussed enough. Your business is your business. As a client, you have a right to expect confidentiality from those who serve you. This may mean your REAL- TOR® not having a loud conversation in a coffee shop, or spilling the beans on who bought the property and why. Mind you, sometimes we use private information with the permission of our clients to help them get what they want. I have personally borne witness to a hand-written note and a picture of the family wanting to buy a property making the difference between one offer and another to a Seller. This is a legitimate tactic when done with the permission of the client. However, doing it without permission, or after the fact at the water cooler is not what most people sign on for. Nor is it what most real estate professionals do.

Accounting: When I think of accounting in my business, it does not necessarily apply just to numbers. That can be part of it for sure de- pending on the deal. Accounting for me falls primarily into the paperwork category. The public tends to focus on price, closing date, in- clusions, and conditions. The Devil is in the de- tails though. I have seen people try to sneak the craziest things into offers. Assignment clauses that would put the Seller at extreme fi- nancial risk should the Buyer default. War- ranties that would hold the Seller responsible for a myriad of things long after the deal has closed. There is even a famous case in California where a Buyer wanted to include the Seller’s dog in the purchase agreement (and actually got it with the Seller’s informed consent in the end).But it isn’t just the extreme cases we need to be aware of. The seemingly benign can come back and haunt you. A missed sig- nature. A missed critical date. A lack of an ac- knowledgement. All of these things create a weak contract that can be used against a client at an inopportune time, and are things that the prudent practitioner must avoid at all costs.

Reasonable Care: In the disclosure section we discussed telling people what you know. I think of reasonable care as disclosure of what you “ought to have known”. We get our real estate information from a variety of sources. Municipal, federal and provincial govern- ments and agencies. The owner. Neighbours. The internet. Inspectors. Colleagues. Some- times we run into situations where there is an undisclosed defect that we did not know about, but perhaps we ought to have known. This is the worst-case scenario for us. Thankfully it does not happen too terribly often. However, the definition of what a fiduciary OUGHT to have known cannot be defined unless and until the problem comes to light after there isn’t any- thing much we can do about it. In those cases, it is often a third party such as a judge that renders a ruling on what we reasonably ought to have known.

Back when I was selling, I sold a property to a client that had a capital improvement charge attached to the tax bill. I did not realize it during the sale process, but on closing, it became apparent that the remainder of the capital charge could not be carried to the new owner on the tax bill, but rather had to be discharged in full.

The capital charge was fully disclosed, but the discharge put my client in a cash position that they hadn’t planned for and could not readily accommodate. I conceded then, and I concede now that in that specific case I ought to have known that. Luckily, the charge was roughly commensurate with my commission!

I made a mistake in that deal, and mistakes happen. I use that story now as a coaching agents coming into the business. The way we represent a client is what most people think about when establishing a relationship, but the duties that the relationship imply are at the very core of the value that a REALTOR® provides to a client.

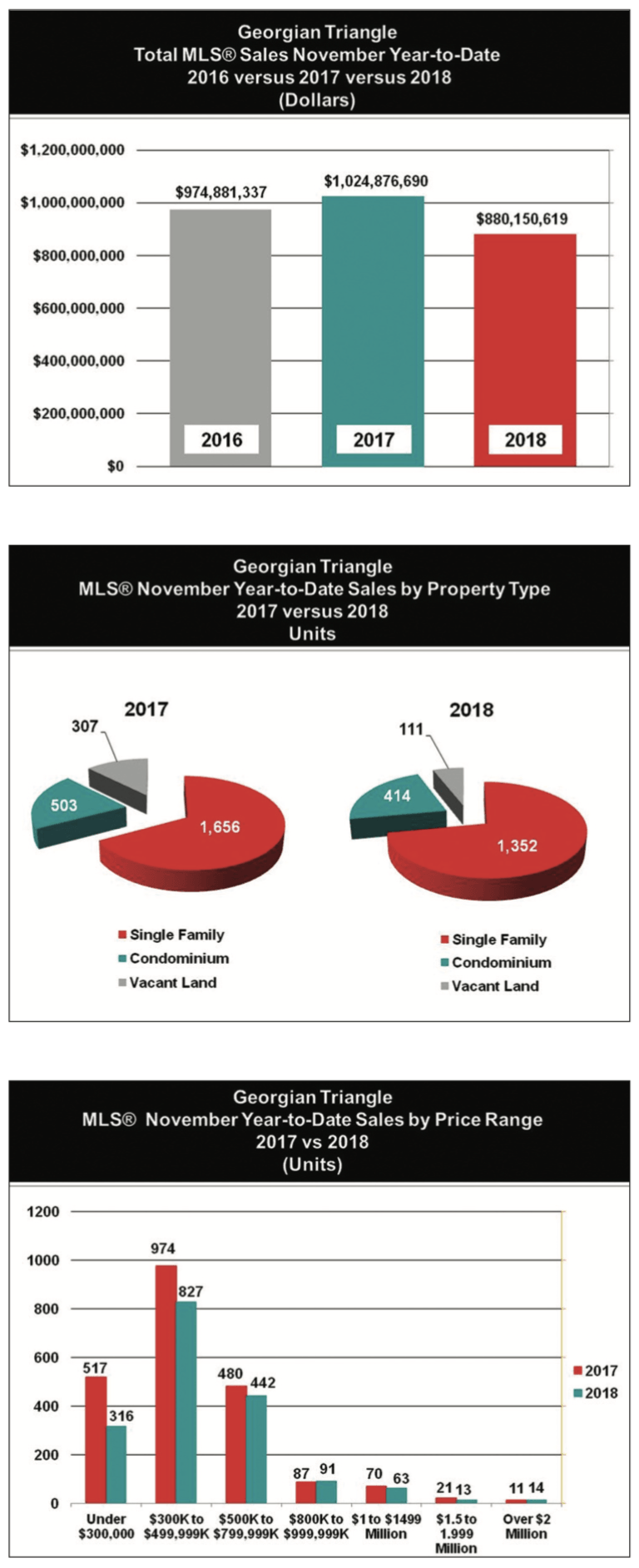

After two years of back-to-back annual MLS sales in 2016 and 2017 that surpassed $1 bil- lion for the first time in each of those years, sales volume for 2018 is going to come in below the level we saw in 2017. Year-to-date MLS® dollar sales to the end of November to- tals $880.2 million, a decrease of 14% from $1.025 billion in MLS® listings sold during the first 11 months of 2017. These year-to-date re- sults for 2018 are also below the results we had in 2016 both in terms of dollars and the number of properties sold. With the holiday season being a priority for many, December is traditionally a slow month for real estate sales and listing activity.

Monthly sales in December are typically below $50 million, this would suggest total annual MLS® sales across our market for 2018 will be in the $925 +/- million range.

MLS® Single family home and condo unit sales are both running at a similar pace and are below the number of properties sold through the first 11 months of 2017. Year-to-date single family home sales total 1,352 units down 18% from 1,656 sold in the same period last year. At the same time condo sales of 414 units are also down 18% from last year when 503 units we sold. In both cases it is important to point out that new home and condo sales made by developers are not in- cluded in these MLS® statistics some of which would account for the softer sales of MLS® resale properties this year. Vacant residential land sales are well below the number sold in 2017 primarily due to a lack of available lots listed for sale.

Sales in most price segments of our market are lower than 2017. Two exceptions to this is the $800,000 to $1 million range where year- to-date sales of 91 properties are up by 4 sales from one year ago. In addition, sales over $2 million are also up modestly with 14 sales re- ported in 2018 compared to 11 in 2017. As per the accompanying chart every other segment of the market is running at a pace below last year. In conjunction with this, e®very municipality in our region has seen adeclineinthenumberofMLS singlefamilyhomesalesthisyearwith decreased unit sal®es running 13% to 22% below the number of homes sold through MLS in 2017.

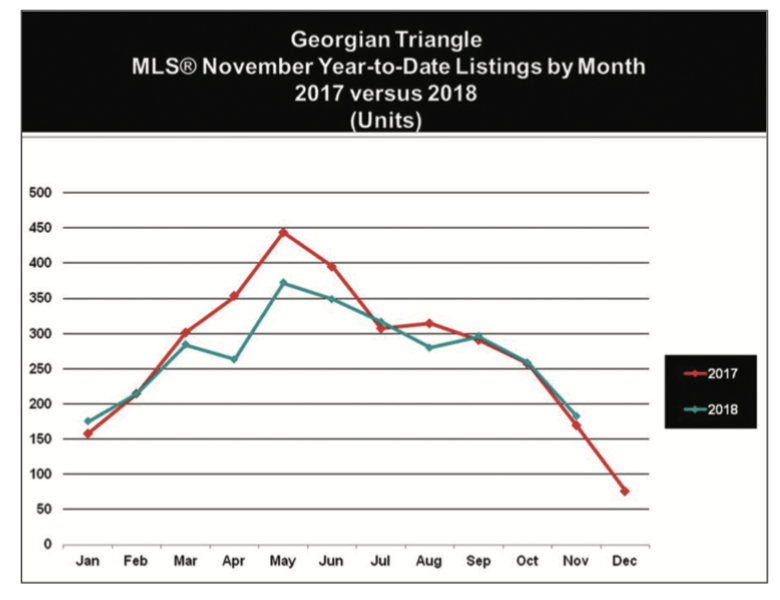

In many segments of the market, reduced levels of inventory have also created a slowdown in sales activity during 2018. Since Septem- ber there has been an up tick in new MLS® listing activity but on a year-to-date basis new listings which total 3,031 properties are still 5% below the number of new listings that came to market in 2017. Again, when you take an in-depth look at the year-to-date MLS® statistics there are always exceptions to the overall results. In terms of inventory, our market currently has an abundance of properties listed for sale priced $750,000 and above. As of the time of this article we have just over 14 months of available inventory for sale priced above $750,000 so there are plenty of options for buyers in this price range and some good value to be had.

Overall, 2018 has brought about a much more balanced market. The frenzied bidding wars we experienced in 2016 and early 2017 have sharply diminished leading to much less stressful market condi- tions for sellers and buyers alike, and we are not alone. Real estate activity in the Greater Toronto Area has also slowed as it also has in large urban centres such as Oakville, Guelph, Cambridge, Kitch- ener/Waterloo, London and elsewhere. These are all strong feeder markets for southern Georgian Bay real estate. A cooling off of market conditions in our region and elsewhere was bound to happen—some of which is driven by increased mortgage interest rates and tighter lend- ing rules.

The demand for southern Georgian Bay real estate is still really vibrant. Whether it is for retirement or recreational use, people still favour the varied four-season lifestyle afforded by property ownership in this area and this is not a trend that is likely to disappear anytime soon.